A recent report by EY researched the adoption of FinTech across 20 markets and over 22,000 online interviews. While it should come as no surprise that FinTech adoption across the globe has been on the rise, the report delved into greater detail on the countries and industries that are driving FinTech adoption.

The report stated that "on average one in three digitally active consumers use two or more FinTech services. That is significant enough for us to suggest that FinTech has reached early mass adoption.

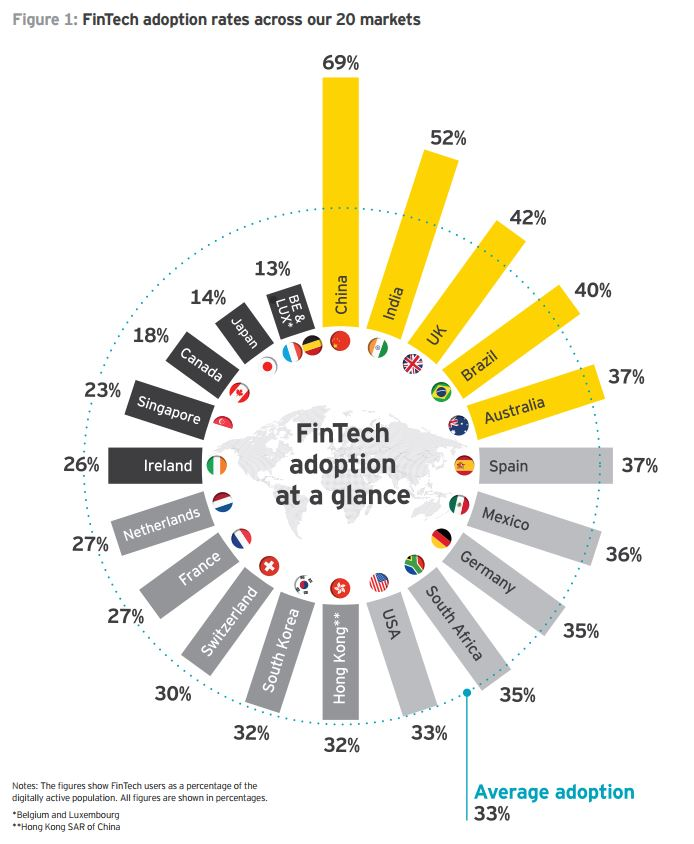

Of the markets surveyed, it should come as no surprise that China, India and the UK topped the table with 69%, 52% and 42% adoption levels respectively. China has seen mass increase of payment services such as AliPay and WeChat Pay (93% adoption across Tier 1 & 2 cities of primary payment methods for offline purchases bringing FinTech services to anyone with a mobile phone. Last November, India’s Prime Minister Narendra Modi made the announcement that the two largest cash note denominations would be rendered worthless. With 86% of the country’s cash out of play , FinTech companies found their time to shine. Then we have the UK where FinTech adoption is at slightly under half considering London is touted as the FinTech capital of the world. However, it is expected that this will grow as even within the peer-to-peer industry we have seen massive growth in the past 12 months.

The report also gave a broad outline of the type of business models that are revolutionising the economics of a market. Included among them is the ability to provide a new service which is exactly where peer-to-peer lending sits. Peer-to-peer companies such as ourselves now allow lenders to invest in loans that would previously have been restricted to banks or large financial institutions (not to mention that lenders on the Relendex platform receive the lion’s share of the interest).

One contradiction we’ve found with the EY FinTech Adoption report is the age demographic of FinTech users. Where the general statement is that "The demographic mostly likely to use FinTech are 25- to 34-year-old consumers, followed by 35- to 44-year-olds. FinTech use declines with consumers aged 45 years and older." we have found the opposite. The average age of a lender on our platform is 54 years with just about 10% falling into the 25-34 year old age bracket. This is possibly due to the fact that individuals looking to manage an active peer-to-peer portfolio are more financially experienced and tech savvy. They see the platform as a way to grow their nest egg especially with the introduction of the Innovative Finance ISA.

Some other interesting findings from the report:

33% is the average FinTech adoption globally, compared with 16% in our 2015 study

50% of consumers use FinTech money transfer and payments services, and 65% anticipate doing so in the future.

64% of FinTech users prefer using digital channels to manage all aspects of their life, compared with 38% non-users.

Read the full report here