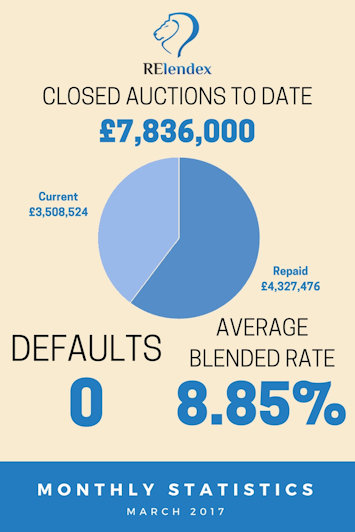

In April 2016, HM Treasury gave the green light to the peer-to-peer lending industry to offer investors more choice alongside existing Cash and Stocks & Shares ISAs. As a FCA fully authorised firm, Relendex is able to offer investors the Innovative Finance ISA (IFISA) providing tax-free investment returns.

...