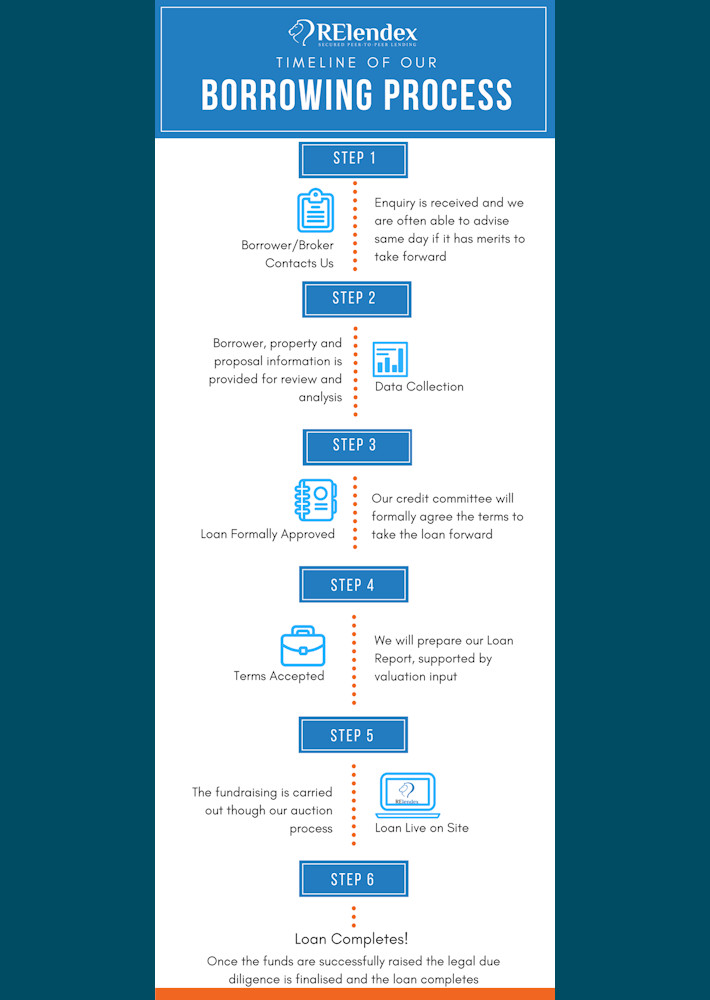

Our timeline for Borrowing

We thought this week we’d walk you through our borrowing process. Whether you are a Lender or a potential Borrower, this will give you a better idea of how our platform works.

Step 1

Borrower/Broker contacts us with their enquiry and basic property details. We are often able to advise on the same day whether it is a deal we would take forward. For a good idea of what we would take forward you can have a look at our Indicative Lending Criteria. As a peer-to-peer lender we are able to offer a degree of flexibility and review each case on its own merits.

Step 2

If not provided at initial enquiry, this is where we will request for more detailed information regarding both the borrower and the property. This will be reviewed and analysed by our Lending Team.

Step 3

Once our Lending Team has completed the loan analysis, it will be put forward to the Credit Committee. They will then formally agree the terms with which to take the loan forward.

Step 4

Subject to the Borrower accepting our terms, we will then prepare the Loan Report supported by valuation input. This will be available to Approved Lenders in our Virtual Data Room.

Step 5

We then place the loan live onto the Auction Marketplace our site. Lenders are then free to place bids on it from a minimum sum of £500.

Step 6

The loan completed when the funds are successfully raised and all legal due diligence is finalised.

If you are looking to make a borrowing enquiry, find out more details here.