Since Innovative Finance ISAs (IFISA) were introduced in April 2016, inventive companies have found sectors where savers can make a real difference to the economy whilst giving savers above average returns on their investments. The recent Cambridge Centre for Alternative Finance report found that for 41% of people investing in property Peer-to-Peer, a key motivating factor is that their investment will make a difference.

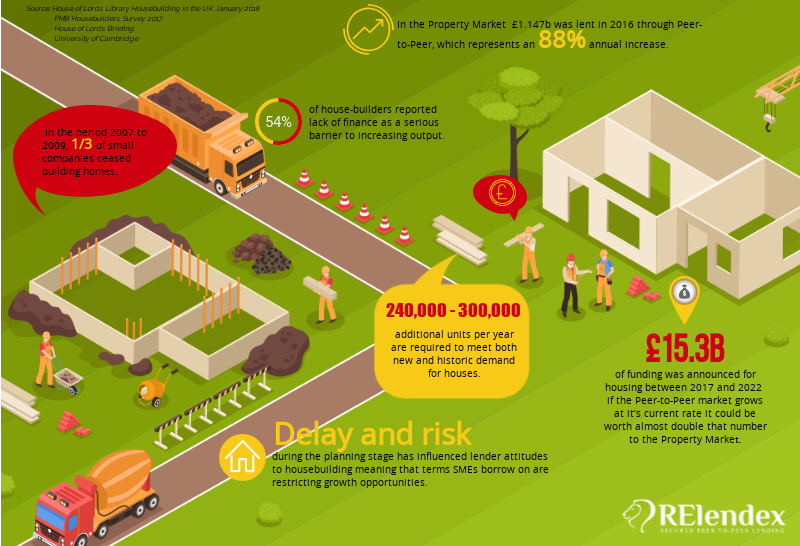

One area where innovative ISA products can make a big difference is funding house building and in turn relieving the housing crisis. It may sound obvious, but we can only house more people if there are units available for them to buy or rent. According to House of Lords Library papers published in January 2018, between 240,000 and 300,000 additional units are required per year to meet both new and historic demand for housing. So whatever policy the Government chooses to push, whether it is building on brown field sites or reducing the size of Green Belt, we need a house building sector that is fit for purpose. Right now, that couldn’t be further from the case.

The housing industry is in desperate need of investment. Over the last twenty years the number of SME house builders has been reduced by as much as 40%. Just last year, the FMB Housebuilders Survey 2017 reported that 54% of housebuilders state that a lack of finance is a serious barrier to increasing output.

Whilst the 2008 economic crisis had a huge impact right across the economy, which has now been largely resolved, the house building sector has still not fully recovered. The decline came as a direct result of the banks and other lenders calling in loans and overdraft facilities in the wake of the crash. There are now significant structural issues in the relationship between the sector and the banks, which means that, in the absence of new forms of finance SME housebuilders cannot return to the market.

This is where Peer-to-Peer lending can provide a major impetus to the industry. Peer-to-Peer lenders can fund the industry whist simultaneously offering savers a high level of returns. Well-designed platforms cut out the middle men and enable lenders to directly fund house projects that appeal to them. The Cambridge Centre report also states that in 2016, £1.147bn was lent in the property market through Peer-to-Peer, which represents an 88% increase on the previous year. This new source of finance will provide a shot in the arm to the industry and will have a transformative effect on housebuilders who are desperately trying to attract new funds. This will ultimately enable them to develop some of the over 420,000 new homes that have been given planning permission but remain unbuilt, and which as a country we desperately need.

Lenders, can enjoy the knowledge that they can earn excellent tax free rates of return by investing in an IFISA, secured on UK property whilst at the same time providing the funds badly needed by our housebuilders.